Mergers and Acquisitions (M&A) are behind many of the most popular brands we know today. Some notable deals to mention include Facebook’s acquisition of Instagram or Microsoft’s purchase of LinkedIn.

However, in 2023, the UK witnessed a big fall in M&A activity. As per PwC, the number of deals was down by 41% when compared to 2022.

But here’s the good news: businesses still have an appetite for mergers and acquisitions! The same report revealed that more than 50% of UK CEOs will make one major acquisition by 2026.

Hence, to make M&As a path to business growth and continue the legacy or, in some cases, become part of someone else’s. In this blog, we’ll take you through the essential M&A topics that you must know.

What are Mergers and Acquisitions?

Mergers and acquisitions refer to the process where two or more companies consolidate into one single entity. This can happen in two ways, through merging or acquisition.

When two companies join to form a single entity, this process is called ‘mergers.’ But if one company purchases another to take control of its business operations, assets, and market share, it’s called ‘acquisition’.

What is an example of a Merger and Acquisition?

Mergers and acquisitions are a strategic decision. They are done with the intention to improve the business’s value, reputation, revenue, or market share. Let’s understand mergers and acquisitions as popular examples.

Merger example

A well-known example of mergers is between Discovery Inc. and WarnerMedia. They merged in 2022 to form Warner Bros. Discovery in a $46 billion deal that shook the entertainment industry.

This merger was mostly about survival. With streaming giants gaining popularity, like Netflix and Disney+, both companies needed to survive against this competition. They combined WarnerMedia’s premium brands like Warner Bros and HBO with Discovery’s reality TV expertise.

In this scenario, companies agree upon cultures, talent, technologies, Intellectual Property, strategies, and so on.

Acquisition example

Everyone’s heard of Pixar, the animation company that became popular with its first-ever 3D Toy Story animated film. It was a massive hit, and instantly became a serious threat to Disney’s dominance.

Disney couldn’t ignore the competition. So, in 2006, they decided to acquire Pixar for $7 billion. Pixar retained its legacy while Disney was able to set a whole new standard for animated storytelling.

Most companies do not just eye the business but also its creativity, talent, and technology. Steve Jobs, Pixar’s CEO, played an important role in the deal, negotiating fiercely to protect and retain Pixar’s culture.

Types of Mergers and Acquisitions

While mergers and acquisitions are the primary ways where two companies consolidate into one, there are different ways a business can achieve this. Let’s explore these in these 7 different types of mergers and acquisitions below:

1. Horizontal M&A

This type of M&A takes place between companies that are operating in the same industry and at the same level of production or service. Think of how Facebook acquired Instagram (both belonging to the same service) to reduce opposite competition.

This merger and acquisition includes the consolidation of product, customer base, market share, and ownership. The main aim is to increase market share, reduce competition, and achieve a stronger position in the market.

2. Vertical M&A

Here, the companies operate in the same supply chain but at different service levels. This typically takes place between suppliers and manufacturers. This greatly reduces costs and improves supply or distribution channels.

For example, Amazon’s acquisition of Whole Foods to integrate into its grocery delivery services.

3. Congeneric M&A

This is a type of merger and acquisition where merging or acquiring companies operate in related industries, offering complementary products or services. They enter adjacent markets, similar to how Disney acquired Pixar and added 3D animation expertise to its portfolio.

Congeneric M&A helps companies combine offerings to expand product lines, cross-sell, and cater to more customers.

4. Conglomerate

Conglomerate merger and acquisition happens between companies belonging to unrelated industries. The objective here is to diversify risk when a business wants to enter new markets or industries to reduce dependency on a single market.

Large corporations typically choose this type of M&A to gain new income streams. You can think of Berkshire Hathaway’s acquisitions of companies from different industries like retail and insurance.

5. Market or product extension

Acquiring companies choose the market or product extension type to set foot into new geographical markets or even expand product lines. This extension helps the company utilise unused customer base or introduce new offerings.

This is an excellent way to also increase market share and distribution channels. It suits businesses that are planning to expand internationally or launch new products. One example is HBC’s merger of Saks Fifth Avenue and Neiman Marcus to consolidate luxury retail brands.

6. Reverse takeover (SPAC)

Reverse takeovers give companies faster access to capital markets with new ownership, management, and financial resources.

Reverse takeover occurs when a private company merges with a publicly listed shell company (Special Purpose Acquisition Company) to go public quickly. It bypasses the usual IPO processes and gives the private company access to public funding.

7. Acqui-hire

Acqui-hire is a type of M&A where a company acquires another company solely for its talent or expertise rather than its product. The acquisition also involves retaining technology and intellectual property.

In this case, take the example of Facebook’s acquisition of Beluga for its messaging talent that led to Facebook Messenger.

What are the typical stages of an M&A transaction?

M&A transaction is the actual deal that happens between companies, involving the legal and financial steps taken to merge or acquire another business. This includes everything from negotiations to finalising the contracts.

Businesses must be aware and understand the technicalities that go behind the deal to make smarter decisions. Because, it impacts everything from company strategies to stock prices if the terms go wrong.

Here are the 5 main stages involved in a merger and acquisition transaction:

1. Preliminary discussions

This is the first stage which sets the foundation for the entire M&A process. Discussions center around strategic alignment, value creation, and the structure of the deal. Often, this process involves bankers or financial advisors.

Public companies might come across the City Code on Takeovers and Mergers (also known as the Takeover Code) for fair treatment of shareholders.

This is so that the business knows if the deal is worth pursuing. Once the parties agree on goals, they move ahead to commit time and resources.

2. Non-disclosure agreements (NDAs)

In this stage, sensitive and confidential information starts flowing between parties. This can include business strategies, financial details, or even customer lists. With a legal agreement like an NDA, businesses can ensure that other parties keep certain information confidential.

This is to avoid any misuse or leakage of information that can be used against the business later, either by a competitor or the acquiring company itself. Here is a quick list of a few things businesses must be aware of:

- Being aware of UK’s GDPR guidelines

- Including what is confidential, along with the duration

- Considering stamp duty, CGT, and HMRC

- Non-solicit clauses

- Process for enforcing the NDA if violated

- Confidentiality obligations

3. Due diligence

This is the process where the company’s finances, legal status, operations, and etc., are evaluated. This is so that the buyer is aware of the risks that might affect the business value in the future.

This step is crucial as it ensures that the business is aware of the target’s value before making any formal commitments.

4. Negotiation and signing agreements

This is where the transaction terms are finalised. Agreements are drafted, including purchase price, payment terms, and conditions for closing. The LOI (Letter Of Intent) turns into binding contracts.

Depending on the transaction, regulatory bodies such as the CMA if the deal negatively affects market competition.

5. Closing and integration

Once all conditions and legal terms are agreed upon, funds and ownership will be transferred. Post-closing integration is where the company focuses on merging business operations and working together.

This is the last step where the transactions are complete and true value creation begins!

Why do companies merge?

While the decision to merge comes from strategic decisions, they can also occur for purely financial operational reasons.

Below are the top 5 reasons why companies merge:

1. Growth and market expansion

One of the main reasons why companies merge is to increase their market presence and become dominant players. This helps them bypass any market barriers while also reaching more customers.

Currently, UK business owners are finding opportunities in the global market for digital and service sectors. These are growing faster than goods trade in the UK, making UK businesses focus on global market strategies to reduce Brexit’s effects.

2. Cost savings through synergies

Larger companies, when combined, reduce costs as they share resources, facilities, and processes. Any overlaps from an administrative and operational perspective is streamlined to save money.

3. Access to new technologies or resources

Companies also merge to bring together R&D teams, new tech, and talent to innovate faster. This also improves the company’s position against competitors. This process also involves patents or specific expertise.

4. Survival and risk reduction

Struggling companies may merge to survive fluctuating markets or protect their financial future. This is because companies that are looking for survival see mergers as a way to access fresh capital and increase revenue.

5. Regulatory and tax benefits

Mergers in the UK offer some tax efficiencies and regulatory advantage. For example, the merging of UK companies allows them to utilise tax reliefs such as Group Relief. This is where losses from one company reduce the taxable profits of another, helping lower the group’s overall tax bill.

How long does a typical M&A deal take?

On average, a typical merger and acquisition deal takes 3 to 6 months. It can take about a month to strategise, 1-3 months to complete due diligence, and another month to close the deal.

However, there’s a chance the M&A deal can be delayed due to regulatory issues, shareholder interests, corporate cultures, and geopolitical issues. Regulatory scrutiny alone can delay the process by 3-6 months, as per Bain & Company.

Mergers and acquisitions statistics in the UK

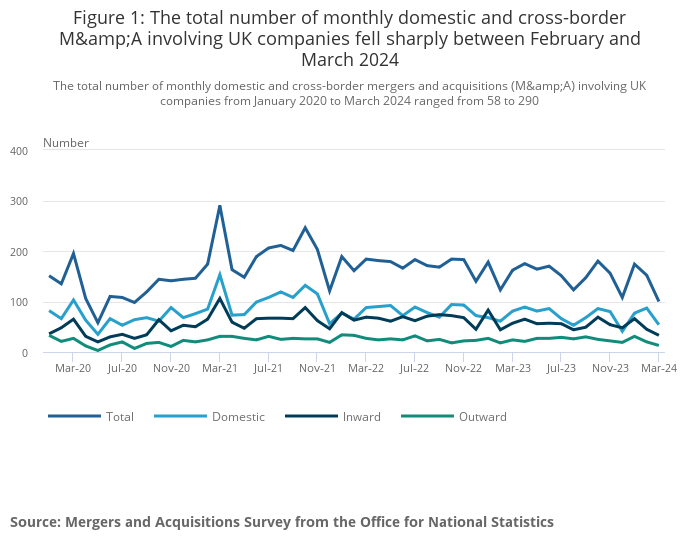

The following are the top 5 mergers and acquisitions statistics in the UK to better understand its state in 2024, as per UK’s Office for National Statistics:

1. M&A activity shows room for strategic growth

The total number of monthly domestic and cross-border M&A transactions in the first quarter of 2024 was 426, which is slightly down from the previous quarter. However, this is a sign for businesses to re-examine their acquisition strategies.

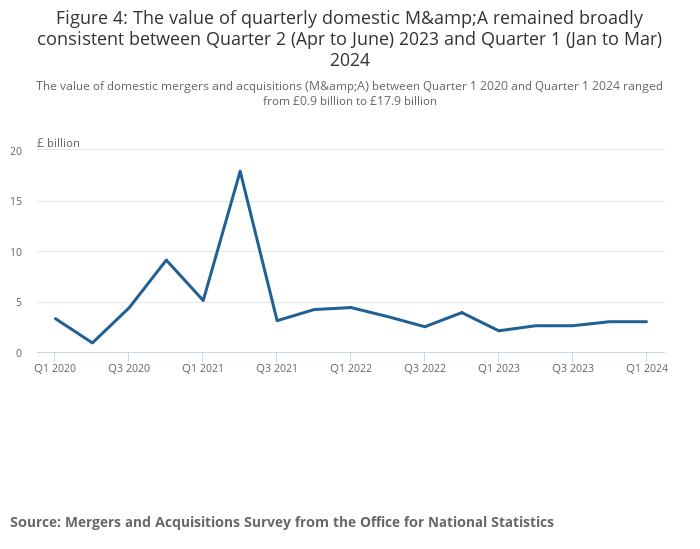

2. Steady domestic M&A activity

Domestic mergers and acquisitions showed good performance with a total value of £3.0 billion in Q1 2024, matching the previous quarter. This shows a healthy environment for companies to grow, expand, and diversify through acquisitions.

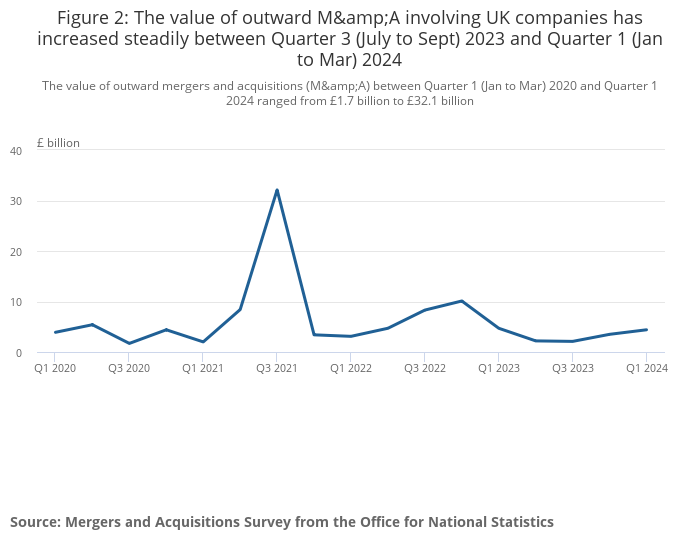

3. A boost in outward mergers and acquisitions

Outward M&A is where UK companies are acquiring foreign businesses. This value grew to £4.4 billion in Q1 2024, up £0.9 billion from the previous quarter. Leading companies like GlaxoSmithKline and AstraZeneca are already making acquisitions abroad.

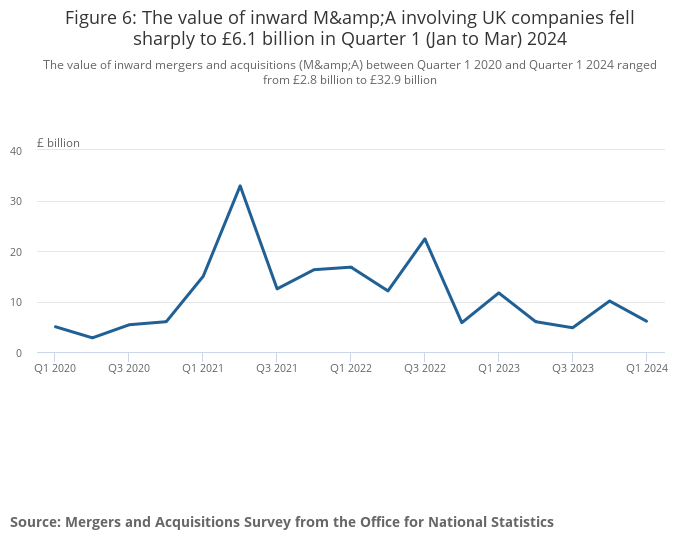

4. Decline in inward M&A

However, inward M&A—where foreign companies acquire UK businesses—dropped very much to £6.1 billion in Q1 2024, from £10.1 billion the previous quarter.

While this may seem like a challenge, it’s also an opportunity for UK businesses to strengthen their positions and increase their appeal to acquirers or investors.

5. Increase in business confidence for M&A

Despite some fluctuations in the deal numbers, the overall M&A market shows continued positive outcomes for businesses. This is owing to increased investment intentions and positive outlooks on the UK’s economic conditions.

The key here is to keep an eye on market trends and position accordingly.

How Mergers Acquisitions UK can help you in mergers and acquisitions

As you look to make the right decisions in a fluctuating M&A market, Mergers Acquisitions UK provides you with the expertise and personalized solutions. We help you move forward with confidence with deep industry knowledge!

We prioritize your financial goals while helping you meet your objectives to grow, diversify, or even secure your exit strategy. Contact us today, and let Mergers Acquisitions UK guide you through these fluctuations at every step of the way.