Equity release was introduced in the UK in the 1960s and since then it has been a lucrative option for UK homeowners. Through the year 2023, more than 26,000 customers took new equity release plans where the average amount borrowed was almost £80,000.

If you are also interested in cashing in on your property while still living in it, then keep reading what equity release is and how to use it.

What is equity release?

Equity release is a way for homeowners, typically those who have retired or are close to retirement, to access the cash tied up in their property without having to sell it.

It involves borrowing against the value of your home, with the loan repaid when you die or move into long-term care. This can provide a lump sum or regular income, useful for various purposes like home improvements, debt repayment, adding an extra income source, or supplementing retirement income.

How does equity release work?

Before understanding how equity release works, you need to know what equity is. Equity is the difference between your home’s value and any outstanding mortgage or other debts secured against it. So, for example, if your home is worth £200,000 and you owe £50,000 on your mortgage, your equity is £150,000.

Here’s how an equity release process typically goes.

Step 1: Property assessment

You start by reaching out to finance and property advisors to get your property assessed so you can find its correct value, which depends on various factors.

After assessing your property’s value you can reach out to your finance advisor to know what is the maximum you can borrow against that property.

Step 2: Choosing a plan

After having a number in your hand you have two different options to choose from, which are:

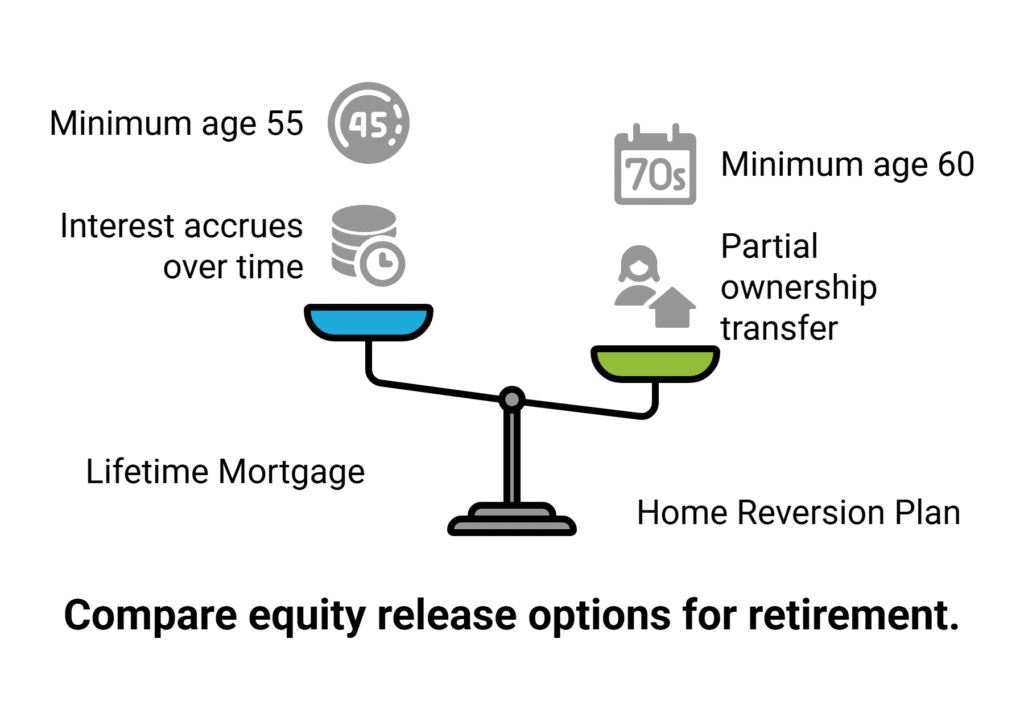

1. Lifetime Mortgage: This is the most common type.

You receive a lump sum or regular payments. Interest accrues on the loan, and the total amount, including interest, is repaid when you die or move into long-term care. You can access this after the age of 55.

2. Home Reversion Plan: You sell part of your home’s ownership to a provider in exchange for a lump sum.

You continue living in the property, but when you die or move into long-term care, the provider sells the property and keeps a portion of the proceeds. For this plan minimum age requirement is 60.

Step 3: Acquiring the funds

Based on your plan and decided amount you choose between either a lump sum payment or a steady regular payment over the course of the period. There is another option of flexible access which lets you draw funds as needed, up to a certain limit.

Advantages and disadvantages of equity release

Now there are a set of advantages and disadvantages connected to this process. Here Mergers Acquisitions UK have discussed them all, so you can make an informed decision.

Advantages of Equity Release in the UK

- Financial flexibility: Equity release can provide a significant lump sum or regular income, allowing you to improve your quality of life, pay off debts, or support loved ones, especially in old age.

- Tax-Free cash: The money you release from your property is generally tax-free.

- Maintain home ownership: You can continue living in your home without the need to sell it.

- Avoid selling your home: Equity release can be a way to avoid the stress and upheaval of selling your home, especially if you have strong emotional ties to it. You can earn from the property while you are alive and it will only be sold after your demise.

- Potential inheritance tax planning: By gifting some of your wealth during your lifetime, you may be able to reduce the amount of inheritance tax payable by your beneficiaries.

Disadvantages of Equity Release in the UK

- Reduced inheritance: Equity release will reduce the amount of your estate that can be passed on to your heirs.

- Rising costs: Interest accrues on the loan, which can significantly increase the amount owed over time.

- Impact on benefits: For some fund-acquiring methods, equity release could affect your entitlement to certain state benefits.

- Difficult to reverse: Once you’ve released equity, it’s difficult to reverse the decision, and early repayment can be costly.

- Professional advice is essential: Understanding the complexities of equity release requires expert advice. Fees for this advice can be significant. However, this could easily be addressed.

Is there a better alternative to equity release?

While equity release can be a viable option for many, it’s important to explore some other options as equity release is almost a permanent option.

Here are some potential alternatives:

1. Downsizing your property

Best suited for individuals who live alone or only with their partner.

- Pros: Releases equity, reduces maintenance costs, and potentially lowers property taxes.

- Cons: Can be emotionally challenging, and moving costs can be significant.

2. Remortgaging the entire property

Best if you are planning to move to a different place but still want to hold onto the property.

- Pros: Access to a lump sum or lower monthly payments.

- Cons: Requires good credit, and interest rates can fluctuate.

3. Retirement Interest-Only Mortgage (RIO)

As the name suggests, it is best for retired people.

- Pros: Lower monthly payments, and flexible repayment terms.

- Cons: Requires a plan to repay the capital amount eventually, often through selling the property or other assets.

4. Selling Assets

- Pros: Immediate access to cash.

- Cons: May involve selling valuable items with sentimental value.

5. Renting Out a Room

- Pros: Regular income, tax benefits, and is a good source of side income that can be expanded based on how much efforts you are willing to put.

- Cons: Requires managing tenants and maintaining the property.

What is a typical interest rate in equity release?

As of November 2024, the base interest rate on equity release is 4.75% which is set by the Bank of England. However, equity release interest rates in the UK typically range from 5% to 7%, depending on the provider and your specific circumstances.

It is because these rates are generally higher than standard mortgage rates due to the nature of equity release and the potential longer term of the loan.

Can I sell my house if I have an equity release?

Yes, you can sell your house even if you have equity release.

However, the proceeds from the sale will first be used to repay the outstanding equity release loan, including any accrued interest. Any remaining balance after repaying the loan will be yours to keep.

However, you should know that in order to sell your house you would first need to obtain the consent of your equity release provider and they may charge you an early repayment fine.

How much equity can I release?

The amount of equity you can release depends on factors such as your age, the value of your property, and your health condition.

The older you are, the more equity you can typically release. Similarly, if you have certain health conditions that affect your lifespan, you may be able to release more equity.

As for the value of your property, the higher the value of your property, the more equity you can release.

Typically people release between 20% and 60% of your property’s value.

How long does equity release take?

The equity release process typically takes around 4-6 weeks to complete. However, this can vary depending on various factors, such as the complexity of your case, the efficiency of your solicitor, and the lender’s processing time.

In some cases, the process may take longer, especially if there are any issues with your property title or other documentation.

What are the rules and regulations for equity release in the UK?

The rules and regulations for equity release in the UK are governed by the Financial Conduct Authority (FCA) and the Equity Release Council (ERC).

These organizations ensure that equity release providers adhere to strict standards to protect consumers.

The key regulations for equity release include:

- Age restrictions: You must be at least 55 years old to qualify for equity release. However, there are some loopholes to this rule.

- Property requirements: The property must be your main residence and located in the UK.

- Independent legal advice: You must obtain independent legal advice before entering into an equity release agreement.

- Clear and transparent information: Equity release providers must provide you with clear and understandable information about the product, including potential risks and benefits.

How much do solicitors charge for an equity release?

Solicitor fees for equity release in the UK typically range from £600 to £1,500. However, the exact cost can vary depending on the complexity of your case and the specific services provided by your solicitor.

How much tax do you pay on equity release?

Typically, you don’t pay any income tax on the money you release through equity release as it is tax-free. You should still consult with a tax advisor in case you have any specific circumstance that you are unaware of.

How much can I borrow with equity release?

The amount you can borrow depends on your age and the value of your property but you can release between 20% and 60% of your property. Therefore, it will be the range for the amount of money you can borrow.

Final words: Is equity release right for you?

There is no universal answer to this. However, Mergers Acquisitions UK can give you an overview of people who may or may not benefit from equity release. You can match your circumstances with that and get the best idea.

Here are some cases when equity release can be a helpful tool.

- Need for a significant lump sum: If you require a substantial amount of money for a major expense, such as home improvements, debt consolidation, or long-term care costs.

- Desire to maintain your home: If you want to stay in your current home and avoid the stress and costs associated with moving.

- Limited income sources: If your pension or other income sources are insufficient to meet your financial needs.

- Inheritance planning: If you want to gift some of your wealth during your lifetime to reduce potential inheritance tax liabilities.

Here are some scenarios when it is best to avoid equity release.

- Need for a large inheritance: If your primary goal is to leave a substantial inheritance to your heirs, equity release could significantly reduce the amount they receive.

- Short-term financial needs: If you only need a small amount of money for a short period, other options, such as a personal loan or a reverse mortgage, may be more suitable.

- Uncertainty about future financial needs: If you’re uncertain about your future financial needs, it’s best to avoid equity release, as it can be difficult to reverse the decision.

- Dependency on state benefits: If you rely on means-tested benefits, releasing equity could impact your eligibility and the amount of benefits you receive.