Access to business funding is crucial for business success in the UK, allowing companies to launch, grow, and innovate.There were 5.6 million private sector businesses in the UK as of 1 January 2023, 0.8% more than in 2022.

At Mergers Acquisitions UK, we are committed to helping entrepreneurs navigate this complex landscape by providing tailored guidance.

This guide explores different funding sources in the UK, supported by data and statistics, to assist business owners in making informed financial decisions and fostering growth and innovation in the UK business environment.

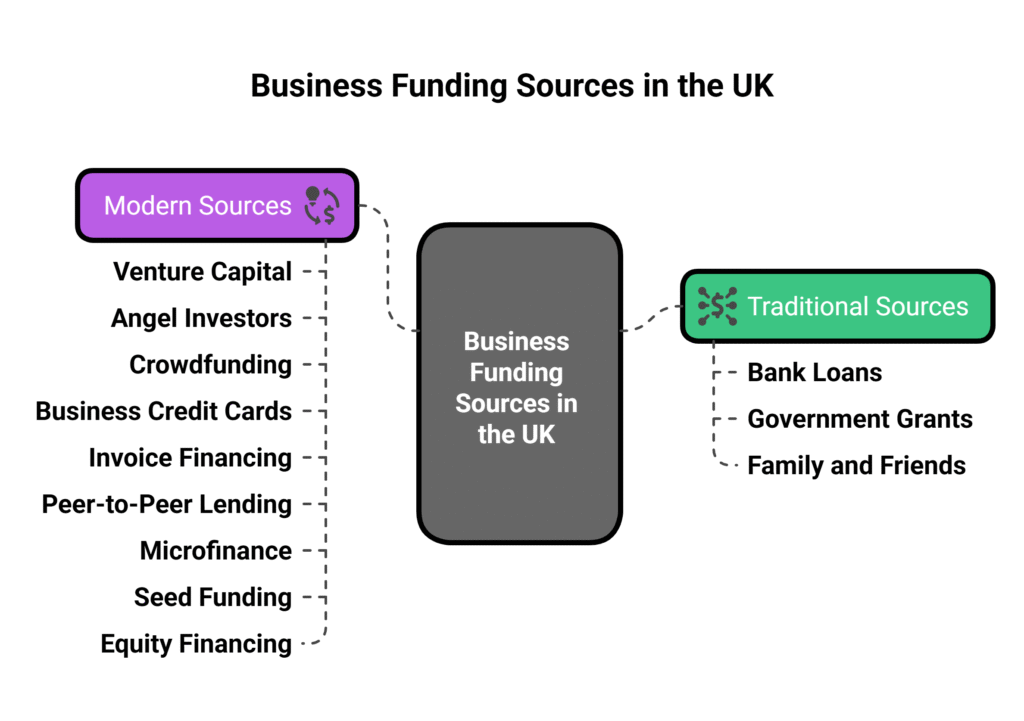

Types of Business Funding Sources Available in the UK

The business funding landscape in the UK is rich and varied, encompassing traditional avenues and modern, innovative options. Understanding each type is essential for entrepreneurs to choose the most suitable financing route for their unique circumstances.

1. Bank Loans

Bank loans are a traditional funding source providing businesses with fixed amounts of capital at a fixed interest rate. Established companies with solid credit histories often prefer this option to seek more enormous sums for significant investments, such as expansion or equipment purchases.

Pros:

- Generally, interest rates are lower than alternative financing options.

- More considerable sums of capital can be accessed.

- Fixed repayment terms allow for better financial planning.

Cons:

- The approval process can be lengthy, often requiring several weeks.

- Requires collateral, which may put business assets at risk.

- Businesses with poor credit may find it challenging to qualify

2. Government Grants

Government grants provide non-repayable funds to support businesses in specific sectors, particularly those focused on innovation, sustainability, and community development. These grants often target startups and enterprises aiming to create jobs or drive social change. Approximately 7% of social enterprises use government or local authority grants as a source of finance.

Pros:

- Non-repayable funds that do not incur debt.

- It can enhance credibility when applying for other funding sources.

- Often come with additional support and resources.

Cons:

- Highly competitive application processes.

- Specific eligibility criteria may limit access.

- Lengthy approval times can delay funding.

3. Venture Capital (VC)

Venture capital is ideal for high-growth startups that need substantial funding in exchange for equity. VC firms invest in promising businesses, often in technology and innovative sectors, and can provide capital, mentorship, and valuable industry connections.

Pros:

- Significant amounts of funding can be secured.

- Access to business expertise and strategic guidance.

- Potential for rapid growth and expansion with investor backing.

Cons:

- Entrepreneurs may lose some ownership control.

- High-pressure expectations for returns on investment.

- It is not suitable for businesses that prefer to remain private.

4. Angel Investors

Angel investors are basically rich people who invest in start-up businesses. They often provide advice, financial support, and mentorship, making them valuable partners for new businesses.

Pros:

- Quick access to funds compared to traditional bank loans.

- Investors often bring industry experience and networks.

- Flexible terms and conditions compared to institutional investors.

Cons:

- Potential loss of equity and control over business decisions.

- Investment amounts may vary widely.

- Reliance on the individual investor’s availability and willingness to invest.

5. Crowdfunding

Crowdfunding platforms allow businesses to raise small amounts of money from many individuals, typically via online campaigns. This funding method generates capital, validates business ideas, and creates a customer base before the product launch.

Pros:

- Provides an opportunity for market validation.

- No need to give up equity or pay back the funds (in donation-based models).

- Builds a community of supporters and potential customers.

Cons:

- Requires a compelling marketing strategy to succeed.

- It can be time-consuming to set up and manage campaigns.

- Success is not guaranteed, and funds may not be raised.

6. Business Credit Cards

Business credit cards offer quick access to funds for everyday expenses and cash flow management. These cards can be helpful for short-term financing, allowing businesses to purchase while deferring payment.

Pros:

- Immediate access to funds for urgent expenses.

- Flexible repayment options.

- It can help build a business credit history.

Cons:

- High interest rates if the balance is not paid off quickly.

- Risk of accumulating debt if not managed carefully.

- Credit limits may be low for new businesses.

7. Invoice Financing

Invoice financing allows businesses to borrow against unpaid invoices, providing immediate cash flow without waiting for customers to pay. This option can be particularly beneficial for companies with extended payment terms and a steady stream of invoices.

Pros:

- Quick access to cash tied up in unpaid invoices.

- No need for collateral beyond the invoices themselves.

- It can improve cash flow without taking on debt.

Cons:

- It can come with high fees that may reduce profit margins.

- Reliance on customer payment patterns can create risks.

- It is not suitable for businesses with slow invoice payment cycles.

8. Peer-to-Peer (P2P) Lending

Peer-to-peer lending connects businesses directly with individual investors, providing a more flexible alternative to traditional bank loans. This method allows companies to negotiate terms and access funding quickly. Crowdfunding/peer-to-peer lending (P2P) is used by a mere 1.2% of social enterprises.

Pros:

- More flexible terms compared to traditional loans.

- Faster approval and funding processes.

- Can provide competitive interest rates.

Cons:

- Interest rates may be higher than those offered by banks.

- It is not suitable for all types of businesses, especially those with poor credit histories.

- Borrowers may face fees for using the platform.

9. Microfinance

Microfinance institutions advance very small loans for start-ups and small businesses, which have not been able to access bank finance. For the past three decades, MFIs have received extensive recognition and an enhanced provision of microcredit services in developing countries within all sectors of the economy. Funding is likely to become the main source of capital for every entrepreneur who intends to open a new business.

Pros:

- Low entry barriers to funding

- Tailored services

- Often include training and support

Cons:

- Small loan amounts

- Higher interest rates than traditional loans

- Not all MFIs are regulated

10. Family and Friends

Funding from family and friends can be an accessible way to raise capital for a new business. This option often involves informal agreements and can provide a financial safety net for entrepreneurs. About 15.3 percent of social enterprises use loans from family, friends, and related enterprises or owners.

Pros:

- Easy access to funds without stringent application processes.

- Flexible repayment terms can be negotiated.

- Support from loved ones can boost morale and motivation.

Cons:

- Risk of straining personal relationships if the business fails.

- Lack of formal agreements may lead to misunderstandings.

- Limited funding amounts may only cover some business needs.

11. Seed Funding

Seed funding is an early investment that helps startups cover initial costs and develop their business model. This funding usually comes from crowdfunding campaigns or angel investors and is very critical in turning ideas into viable businesses.

Pros:

- Provides essential capital for early-stage businesses.

- It can attract further investment down the line.

- They are often accompanied by mentorship and networking opportunities.

Cons:

- It may require giving up equity in the business.

- Competitive landscape for securing seed funding.

- Pressure to deliver results quickly to attract follow-on funding.

12. Equity Financing

Equity financing involves selling a portion of the company’s ownership in exchange for capital. It refers to all financial resources that are provided to firms (mainly growth-oriented and innovative start-ups) in return for an ownership interest.

Pros:

- No repayment obligations, freeing up cash flow.

- Access to investor expertise and networks.

- Can enhance credibility with customers and suppliers.

Cons:

- Dilution of ownership and control over business decisions.

- Pressure to achieve high returns for investors.

- Complex legal and regulatory requirements.

FAQs

Which funding sources are most accessible for different business stages?

Startups often find funding through crowdfunding, microfinance, and contributions from family and friends. Businesses may turn to bank loans, angel investors, and venture capital for more significant amounts as they grow.

Established companies can explore equity financing, development capital, and grants. Each source has its accessibility based on the business stage, financial health, and growth potential.

How much funding can a new business typically get in the UK?

In the UK, new businesses can typically secure anywhere from a few thousand pounds through crowdfunding to about £500,000 from angel investors.

Bank loans can start at £10,000, while government grants often range significantly, sometimes capped at around £2 million. The amount ultimately depends on the business plan, market potential, and the lender’s risk assessment.

How long does it take to secure business funding?

The timeline for securing business funding can vary greatly. Crowdfunding campaigns may take a few weeks to a few months to reach their goal.

Due to extensive due diligence, Angel investments and venture capital processes often extend over several months. Bank loans generally take 2 to 8 weeks, while securing government grants can take several months or longer, depending on the application process.

Can I get business funding with bad credit?

Yes, securing business funding with bad credit is possible, though options may be limited. Peer-to-peer lending and microfinance institutions often have more flexible criteria than traditional banks, making them viable alternatives.

However, businesses may face higher interest rates or less favorable terms, so it’s essential to thoroughly evaluate the implications of taking on such funding.

Do I need collateral for all types of business funding?

Not all funding types require collateral. While bank loans and asset-based financing typically do, government grants and equity financing usually do not require collateral, focusing instead on the viability of the business concept.

It’s essential to review the specific requirements of each funding source to understand whether collateral will be necessary.

Can I have multiple funding sources at the same time?

Yes, businesses can use multiple funding sources simultaneously.

For example, a startup might combine crowdfunding for initial capital with a bank loan for further development.

However, managing multiple funding sources requires careful planning to ensure compliance with different obligations and avoid conflicts arising from varying funding terms.

What’s the minimum trading time needed for business funding?

The minimum trading time needed for business funding varies by source.

For example, many government grants require at least 6 months of trading history, while bank loans typically require 1 to 2 years to assess the business’s creditworthiness.

Startups should prepare their financial documentation early to increase their chances of securing funding.

What financial documents do I need to prepare?

Vital financial documents needed to secure funding typically include a comprehensive business plan, recent financial statements (such as balance sheets and profit and loss statements), tax returns, and recent bank statements.

A credit report may also be required to assess creditworthiness. Having these documents ready can streamline the application process and improve the chances of securing funding.

Do I need a business plan for all funding types?

Most prospective funders like to receive a business plan as an initial move towards making an investment or not.

Different types of investors will want different sorts of information from a business plan, have different expectations over what the business plan ought to include and will ask questions over the business plan differently.